Table of Content

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. A steady income, more equity and low debt are key to getting approved with bad credit. Learn the ins and outs of a home equity loan vs. a home equity line of credit to decide which option is best for your financial goals. You should consider deducting the interest on your home equity loan if you used the cash to “buy, build or substantially renovate your home,” according to the IRS. This may be a bit of a surprise if you took out a home equity loan after Dec. 15, 2017, when the Tax Cut and Jobs Act was passed.

“Acquisition debt is a loan to buy, build, or improve a primary or second home, and is secured by the home,” says Amy Jucoski, a certified financial planner and national planning manager at Abbot Downing. Youll receive a closing disclosure three business days prior to closing, which provides a breakdown of all the costs paid when your home was purchased. Just don’t confuse a home equity loan with a home equity line of credit, or HELOC.

How Does LendingTree Get Paid?

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Getting a HELOC when one is available also makes more cash accessible in an emergency. Again, interest on a HELOC only applies when homeowners use the money, so the cost of getting one is relatively low. Therefore, it can be a good move to get one if you think that you might lose your job. If you wait until after a job loss, then you might not have sufficiently good credit to get a HELOC.

The federal government encourages you to purchase a home by allowing for the deduction of mortgage interest. Although other requirements exist, only the interest you actually pay during the year is eligible for a deduction. If you make a late mortgage payment in the following tax year, you must wait until that year to claim the deduction. You can also look online for rates to compare lenders with your current mortgage lender prior to fully applying for a HELOC. You may want to complete online prequalification with a few lenders, which can give you a sense of the terms and rates theyre offering, as well as the fees theyll charge.

How Much Is Tax In Georgia

If you don't qualify to either deduct the points in the year paid or deduct them ratably over the life of the loan, or if you choose not to use either of these methods, the points reduce the issue price of the loan. This reduction results in original issue discount, which is discussed in chapter 4 of Pub. You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if tests 1 through 6 are met.

If you’ve paid off your mortgage, then you’re still able to deduct your HELOC interest as long as you meet the other requirements, such as only using the funds for home upgrades. If you have a mortgage and home equity debt, what you owe on the mortgage will also come under the $750,000 limitif its a new mortgage. Older mortgages may be covered under the previous $1 million limit . In most cases, you don’t need to pay tax on credit card rewards.

Homeowner’s Guide to Home Equity Loans and Lines of Credit

Hilarey is the editorial director for The Balance and has held full-time and freelance roles at a variety of financial media companies including realtor.com, Bankrate, and SmartAsset. She has a master's in journalism from the University of Missouri, and a bachelor's in journalism and professional writing from The College of New Jersey . Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. He covers banking, loans, investing, mortgages, and more for The Balance. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades.

If you make annual or periodic rental payments on a redeemable ground rent, you can deduct them as mortgage interest. If you're married filing separately and you and your spouse own more than one home, you can each take into account only one home as a qualified home. However, if you both consent in writing, then one spouse can take both the main home and a second home into account.

How Do You Claim A Home Equity Loan Tax Deduction?

You can choose to treat any debt secured by your qualified home as not secured by the home. This treatment begins with the tax year for which you make the choice and continues for all later tax years. You can revoke your choice only with the consent of the IRS. This isn’t a secured debt unless it is recorded or otherwise perfected under state law. Generally, home mortgage interest is any interest you pay on a loan secured by your home .

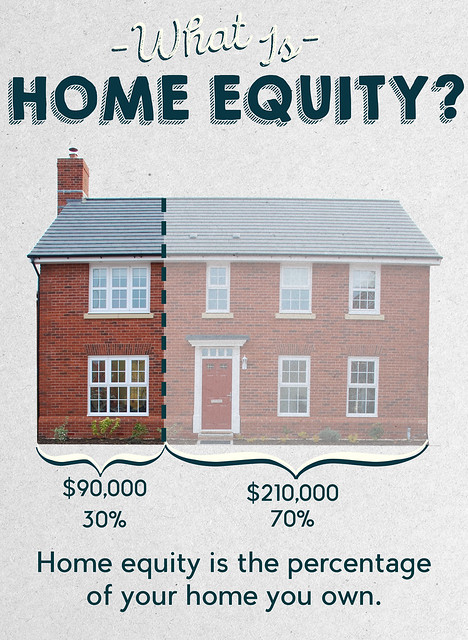

Finally, show your Closing Disclosure and mortgage deed, and you can prove how you used the funds. Here’s how the TCJA affects whether you can deduct your home equity loan interest. A home equity loan is a consumer loan allowing homeowners to borrow against the equity in their home. Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool. Approve or reject authorization requests from tax professionals. Form 9000, Alternative Media Preference, or Form 9000 allows you to elect to receive certain types of written correspondence in the following formats.

If you took out your home equity loan prior to Dec. 15, 2017, your limits are higher, at $1 million for joint filers and $500,000 for separate filers, as long as the funds were used to buy, build or improve the home. If you use them to improve your home or build a second home, you may be eligible to take the tax deduction on the interest paid. You must provide receipts, bank statements, contracts and proof of payments made to contractors or other home improvement companies. In addition, you must prove how you used the funds, so there’s no assumption it was used for anything other than to do with your home. The good news is you can take the deduction on a first or second home, just not investment homes.

A ground rent is an obligation you assume to pay a fixed amount per year on the property. Under this arrangement, you're leasing the land on which your home is located. You don't rent the same or different parts of your home to more than two tenants at any time during the tax year. If two persons share the same sleeping quarters, they are treated as one tenant. If you rent out part of a qualified home to another person , you can treat the rented part as being used by you for residential living only if all of the following conditions apply.

You can't fully deduct in the year paid points you pay on loans secured by your second home. The points weren't paid in place of amounts that are ordinarily stated separately on the settlement statement, such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes. This means you report income in the year you receive it and deduct expenses in the year you pay them.

Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision. Also, remember that you can’t deduct your home equity loan interest if you take the standard deductions, which are slightly higher in 2021 versus 2020. If you aren’t sure whether to itemize or take the standard deduction, contact a tax professional for guidance. This is the last year you’ll be able to take the residential energy credit.

Starting with your 2018 return, you can no longer deduct more than $10,000 for state and local property taxes combined, or $5,000 if you are married but filing separately. If you want to claim the interest deduction for your home equity loan, you’ll have to itemize your deductions. An itemized deduction is an expense that reduces your adjusted gross income, lowering your overall tax bill. When it’s time to do your taxes, here are a few things to know about claiming the home equity loan interest tax deduction.

No comments:

Post a Comment